The earliest attempts to classify motor oils were made when automobiles first appeared. Even at this early stage, viscosity was recognized as one of the most important characteristics of oil. For this reason, the Society of Automotive Engineers (SAE), in co-operation with engine manufacturers, developed the original SAE J300 viscosity grading system for engine oils way back in 1911.

Oils were assigned numbers based on viscosities at certain temperatures. Over the years these standards were updated several times to keep in pace with engine developments and technology advancements.

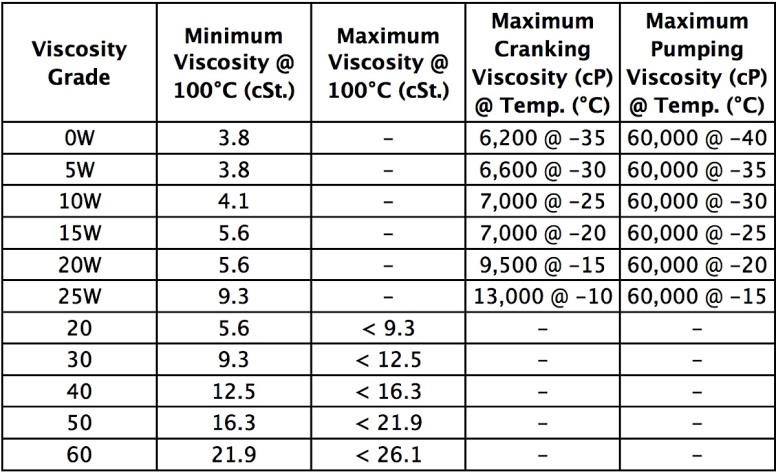

It has been recognized that oil viscosity at colder temperatures, as well as at high operating temperatures, is very important in the performance of an engine. The SAE has therefore devised two separate viscosity measurement systems, one at a high temperature (100°C) and one at very low temperatures. A rotating viscometer, called a cold cranking simulator, is used to measure viscosities at temperatures as low as -35°C. Because the viscosities are measured in two different temperature ranges, the results are reported in two different units.

The first unit is the centipoise (cP). It is used to report the absolute viscosity of motor oil at low temperatures. This number indicates the ease with which the oil can flow when cold. The other unit is the Centistoke (cSt) which is used to report the kinematic viscosity of motor oil at higher temperatures.

Oils that are suitable for use in colder temperatures are identified by the letter “W” when indicating the SAE viscosity grade. These oil grades must meet maximum viscosity limits at specified sub-zero temperatures and must also meet maximum requirements for the borderline pumping temperatures at very low temperatures. Oils that are suitable for use at higher temperatures have viscosities within specified ranges at 100°C. The standards below have been used to classify engine oil viscosities for a number of years:

SAE BOO Engine Oil Viscosity Grades

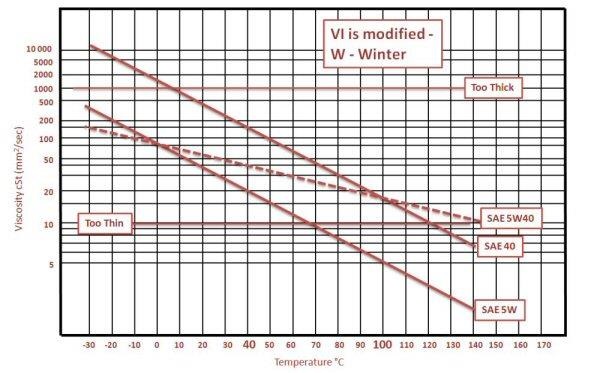

If we draw graphs of typical SAE 5W and SAE 40 monograde oils with viscosity plotted as a logarithmic function on the vertical axis against temperature as a linear function on the horizontal axis, we will end up with the two solid red lines in the diagram below:

The SAE 5W oil will flow sufficiently at low temperatures to protect engines during startup on cold mornings but will be too thin to provide adequate protection at operating temperatures. The SAE 40 oil on the other hand will perform satisfactorily at operating temperatures but will be too viscous to flow sufficiently during startup on cold mornings. The solution? An oil that is ‘thin’ on cold mornings but with a viscosity similar to that of a SAE 40 at operating temperature. But how do we achieve that? With a viscosity modifier (viscosity index improver).

A viscosity modifier (VM) is an oil additive that is sensitive to temperature. At low temperatures, the VM contracts and does not impact the oil viscosity. At elevated temperatures, it expands and an increase in viscosity occurs. If we use a thin oil (let’s say the SAE 5W above) as base and add sufficient VM to meet SAE 40 viscosity limits at 100°C, we end up with a SAE 5W-40 multigrade oil – the red dotted line. Similarly, there are SAE 15W-40, SAE 20W-50, etc. multigrade engine oils available in the market. Multigrade oils provide better engine protection at low and high temperatures than monograde oils because they maintain optimum viscosity over the full engine operating temperature range.

Of particular interest is the inclusion of three new high temperature viscosity grades in the latest revision of the SAE J300 Engine Oil Viscosity Classification Standard. They are SAE 16, SAE 12 and SAE 8 (not shown in the table above). These new grades reflect the continued industry push for lower viscosity engine oils to achieve improved fuel economy. They establish specifications to standardize new lower viscosity lubricants such as SAE 5W-12, or even SAE OW-8, in the marketplace.

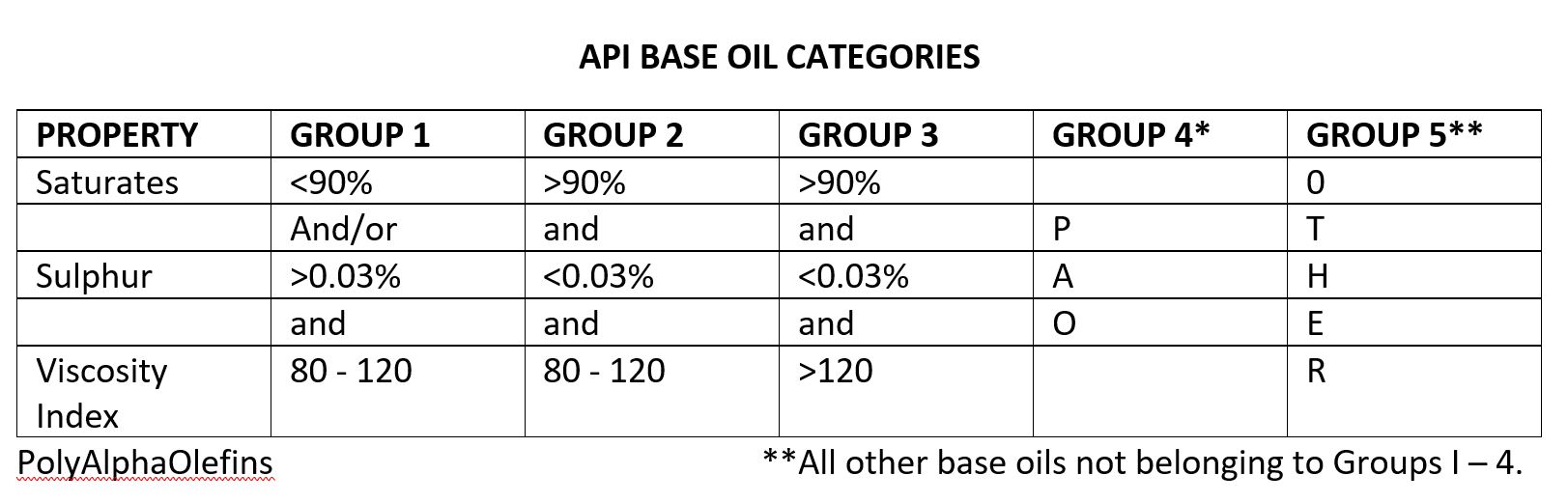

In most instances lubricating oil is a blend of base oil and additives with the base oil content being anything between 70 percent and more than 99 percent depending on the final application of the lubricant. Base oils may be mineral, synthetic or semisynthetic – a mixture of mineral and synthetic stocks. Most lubricating oils used globally (more than 90 percent) are blended using mineral base oils. Feed stocks from a number of streams at crude oil refineries are processed at base oil refineries to produce various viscosity grades of mineral base oils. A typical mineral base oil refinery will have the following units to produce suitable quality base oils:

In most instances lubricating oil is a blend of base oil and additives with the base oil content being anything between 70 percent and more than 99 percent depending on the final application of the lubricant. Base oils may be mineral, synthetic or semisynthetic – a mixture of mineral and synthetic stocks. Most lubricating oils used globally (more than 90 percent) are blended using mineral base oils. Feed stocks from a number of streams at crude oil refineries are processed at base oil refineries to produce various viscosity grades of mineral base oils. A typical mineral base oil refinery will have the following units to produce suitable quality base oils:

p price increases. But why is this and how has Covid-19 affected international lubricant supplies? We operate in a truly global economy and nothing has illustrated this more than the current, ongoing raw material shortages caused by the worldwide pandemic.

p price increases. But why is this and how has Covid-19 affected international lubricant supplies? We operate in a truly global economy and nothing has illustrated this more than the current, ongoing raw material shortages caused by the worldwide pandemic.